APACS (The UK Association Of Clearing Services) has revealed a five-year snapshot of online banking, telephone banking and Internet shopping in the UK. The surprising results of the study have shown that the growth in online banking has been fuelled by silver surfers.

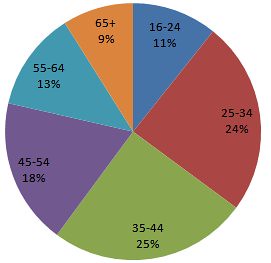

Between 2001 and 2006, the number of Internet banking users aged 55-64 increased 425% and those aged 65 and over increased 275%, making them the two demographic groups with the largest percentage growth. The demographic distribution of i-banking users by age group is shown in the graph below:

A separate report by Ofcom also found that over-65s also spend the most time online, per active user. The group spent on average 42 hours a month, which is rather high compared to the 30 hours spent by most average users per month.

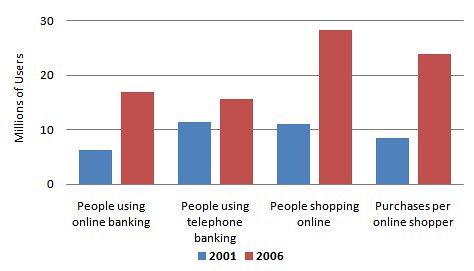

The APACS report also found that the number of people shopping online had grown a healthy 157% from 2001 to 2006. Data shows that those who used online and telephone banking services made the most purchases online, followed by those who use only online banking. People who do not use online banking on average made only half as many purchases as those who did.

The most popular sectors in terms of the number of people buying online in 2001 were books, CDs, travel and clothes, and these remain the most popular sectors in 2006. Unlike on the high street where the debit card reigns, the credit card is the most popular online payment method, with 252 million transactions last year, an increase of 29 per cent on the previous year. The preference for using this type of card for online shopping is probably because of the increased protection credit cards provide.