Fintech businesses operate in a hyper-competitive market with a specific set of challenges unique to the sector. One of the most important factors that determine the success of fintechs is trust – establishing it quickly can set up the brand for success. As a leading fintech SEO agency, AccuraCast is dedicated to building and maintaining client trust.

In this article, our specialists share some of the tried and proven strategies we use to improve trust, not just for SEO but also for the customers who will put their faith (and their money) in the business.

Why trust matters in YMYL

If an AI answer or Google’s top organic search results give incorrect advice, it’s not just the brand’s reputation that is at stake. The platforms themselves risk losing consumer trust.

In 2024, nearly 20,000 financial promotions were withdrawn or amended following intervention from the UK’s FCA – nearly double the amount in 2023. These were mainly cryptoasset, debt solutions, and claims management company (CMC) promotions, some of which were widely covered in the press due to celebrity or high-profile influencer involvement. This resulted in a fall in consumer trust in all three sectors.

What impact does E-E-A-T have on fintech

To meet Google and ChatGPT’s quality expectations for YMYL content, fintech companies must focus on proving experience, expertise, authoritativeness and trust (E-E-A-T). Websites that don’t meet the minimum E-E-A-T quality framework’s rating guidelines, are unlikely to rank highly in organic search or AI-generated answers for any popular search terms.

Fintech companies must focus on demonstrating E-E-A-T in the following ways:

- Experience – content should be written by professionals with verifiable experience in the fintech sector, and the business itself must have verifiable experience, demonstrated through real-world case studies and client testimonials.

- Expertise – websites and the authors should show deep knowledge of the subject matter, cite sources clearly, and state the author’s qualifications to talk on that subject.

- Authoritativeness – the firm and authors should be recognised as authorities within the sector, which can be achieved by earning mentions and links from other reputable websites catering to the sector.

- Trustworthiness – companies should be accurate, reliable, transparent and secure. This article focuses on how fintech brands can demonstrate trustworthiness for SEO and GEO,

Strategies to improve trust for SEO

Building trust is challenging for all new businesses. The baseline for trust is much higher for fintechs, because they deal with people’s money and their competitors are usually established brands with a legacy of trust and media coverage.

Keeping in mind the signals search engines and LLMs look for when gauging trust, here are 7 strategies that can improve trust for fintech SEO:

-

Clear disclosures & transparency

The FCA and SEC provide strict guidelines on disclosures and disclaimers, even where those disclosures must appear. But fintechs don’t have to do the bare minimum. Being proactive and addressing the risks and limitations of a financial technology head-on can actually build trust in the brand.

Transparency is gauged on the basis of multiple factors, including:

- Authorship and creator credentials.

- Site-level information detailed in ‘About us’ and ‘Contact us’ pages.

- Advertising and sponsorship disclosures.

- Monetisation purposes of specific pieces of content.

- AI-generated content disclosures.

- Data use and data-sharing transparency.

- Terms of service and refund policies.

- Clear attribution of sources.

- Evidence to support claims.

Stock and crypto trading app, eToro includes disclaimers and risk warnings in multiple places on their website, in clear language, with the same font size and colour. This is especially important in the high-risk, low-trust cryptocurrency sector, which is an important market for the firm.

-

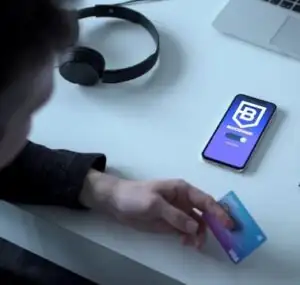

Overtly compliant – make safety visible

It’s not sufficient to just be compliant. Fintech websites need to pointedly make their compliance visible. This helps search engine spiders and manual raters pick up on trust signals that are important for E-E-A-T.

Clearly marked, visible safety precautions also make it easier for LLMs to detect and understand that the content is trustworthy. Practical ways fintech websites can highlight safety include:

- Clearly display authorisations and regulatory licenses, such as FCA registration numbers.

- Link to official listings where possible.

- Declare risks clearly, right next to the product or call-to-action.

- Display recognisable safety icons, such as secure checkout, SSL certifications, Banno monitor protection, PCI security standards, and encryption standards.

- Publish investor protection frameworks with clearly sign-posted complaints processes.

- Highlight independent audits and/or certifications like ISO.

Money transfer service, Wise, declares high up on their homepage that they are regulated by the Financial Conduct Authority (FCA) in the UK. This is bolstered with their claim of servicing over 700k customers and a 24/7 support service.

-

Add visible trust marks

As mentioned in the previous point, adding visible security marks can help build trust in fintech platforms. Taking this a step further, fintech companies can also add other trust marks on the website, in apps, and even on advertisements. Widely recognised trust marks include:

- Visa, Mastercard and Amex logos, especially for platforms that issue cards or accept payment by credit card.

- Regulatory and security marks such as the FSCS Protected, FDIC Insurance, and FCA & Prudential Regulation Authority registration.

- App store logos with app ratings.

- Review site widgets with ratings, such as TrustPilot and Google.

- Award wins, such as “Best consumer banking app” by recognisable or authoritative organisers.

- Consumer protection body accreditations, such as “Best rated by Which?”

-

Strengthen brand authority with positive press coverage

Press and media coverage play a powerful role in building trust. Third-party validation, especially in the form of mentions in high-authority news sites go a long way towards establishing trust and raising authoritativeness. Being listed as a top provider in the sector by publishers like Nerdwallet and Money Week increased AI search visibility for investment management app, Acorn.

These third-party mentions also get picked up by LLMs and included in their answers, counting towards indirect brand mentions, which carry a lot of weight in the algorithms and in the eyes of customers.

Partnering with an expert digital PR and link building agency, especially one that specialises in the fintech or financial services sector, can help quickly elevate the trustworthiness of newer fintech scale-ups and start-ups. Read our guide on link building and digital PR in regulated financial markets.

-

Invest in offline advertising

In spite of – or maybe because of – the progress made with digital technologies, people still tend to trust brands that advertise out of the home and on TV a lot more than brands that only advertise online. Consumers often sub-consciously consider brands they see regularly on billboards and on TV to be more trustworthy. In London, advertising on the Underground is almost seen as a mark of fintech maturity – as witnessed by this ad by Monzo.

A large scale study titled, ‘Advertising and Brand Attitudes: Evidence from 575 Brands over Five Years‘ found that national traditional media increased perceived quality and value more than digital ads. Similarly, a study by the OAAA found digital out of home (DOOH) advertising drives favorability and action among consumers, more than other media formats in the USA. More broadly, research suggests that OOH and traditional media formats score higher on trust and brand recall.

While OOH and TV advertising can be a lot more expensive than digital, they can quickly build brand trust, and the online buzz generated by these ads can also earn editorial brand mentions, which in turn boost SEO.

-

Earn good customer reviews

Positive reviews and word of mouth can drive adoption and trust in the early days of a fintech. The neobank, Revolut, grew rapidly in its early days largely through word of mouth and a smart referral programme.

Fintech services with a high TrustPilot, Google, feefo, G2, Capterra, or App Store / Play Store rating should display this prominently, and mark it up with the appropriate schema to ensure LLMs and search spiders can “understand” this trust signal on their site.

Modern customer journeys begin on Google or ChatGPT, and both of these platforms draw on customer feedback information from review sites when formulating an answer with a recommendation. It is critical for fintech companies to take control of their reviews, encourage happy customers to leave honest, positive reviews, and deal with negative reviews promptly and professionally.

-

Build topic depth & authority

Last, but not least, demonstrating topic depth builds authority, and in turn this too can build trust. This can be one of the cheapest ways for fintechs to build trust, and is a method that remains largely within the organisation’s control.

When a site covers a particular topic extensively, answering questions from fundamentals to advanced, niche, sub-topics, Google recognises that the content likely comes from subject-matter experts, not generalists. This improves the trustworthiness factor in E-E-A-T through validation, especially when the content is consistently written by authors with credibility and is backed up by trusted source citations.

Summary

Building trust takes time, and requires focus on E-E-A-T. Picking just one of the strategies we’ve shared will not be enough in most cases. Fintech marketers need to implement dedicated campaigns with the aim of demonstrating experience, establishing expertise, and growing authoritativeness and trustworthiness on an on-going basis.

This can be a time-consuming exercise, which is why marketing leaders often work with a specialist fintech SEO agency like AccuraCast that understands the market, has the right capabilities and can easily do the heavy lifting, freeing up their in-house team’s time to focus on strategic growth initiatives.

It’s not sufficient to just be compliant. Fintech websites need to pointedly make their compliance visible. This helps search engine spiders and

It’s not sufficient to just be compliant. Fintech websites need to pointedly make their compliance visible. This helps search engine spiders and  In spite of – or maybe because of – the progress made with digital technologies, people still tend to trust brands that advertise out of the home and on TV a lot more than brands that only advertise online. Consumers often sub-consciously consider brands they see regularly on billboards and on TV to be more trustworthy. In London, advertising on the Underground is almost seen as a mark of fintech maturity – as witnessed by this ad by Monzo.

In spite of – or maybe because of – the progress made with digital technologies, people still tend to trust brands that advertise out of the home and on TV a lot more than brands that only advertise online. Consumers often sub-consciously consider brands they see regularly on billboards and on TV to be more trustworthy. In London, advertising on the Underground is almost seen as a mark of fintech maturity – as witnessed by this ad by Monzo.