Financial services companies operate in one of the most competitive, highly regulated, and trust-dependent digital markets. AccuraCast is an SEO agency for finance firms; our experts help banks, insurers, fintechs, wealth managers, and advisory firms grow their organic visibility responsibly and sustainably.

Here are 10 SEO tips our financial services experts recommend, combining traditional best practices with emerging SEO for AI (GEO) techniques:

1. Start with deep, intent-led financial keyword research

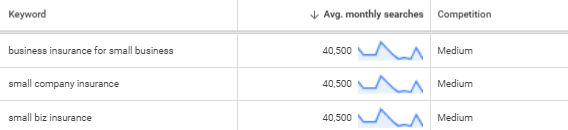

Focus on keywords that aren’t just competitive, but carry high user intent and ones that reflect complex decision-making. Using long-tail, product-specific terms allows your content to attract more qualified leads. For example, “best employee benefits insurance for SMEs” will probably bring far stronger conversions than broad keywords like “insurance quotes”.

The research process typically includes:

- Start with core product & regulatory mapping

List your products, services, and regulated terminology (e.g., “SME health insurance,” “professional indemnity,” “ISA limits”). - Analyse search intent at every stage

Financial decisions are multi-step and research-heavy. Map keywords to the full funnel:- Top-funnel: “what is excess liability insurance”

- Mid-funnel: “best liability insurance for small businesses”

- Bottom-funnel: “excess liability insurance quote UK” This helps build clearly defined content for both education and conversion.

- Analyse competitor & aggregator positioning

Review rankings for major competitors, comparison sites, and fintech disruptors. Aggregators often claim top spots. - Build long-tail, high-intent variations

Financial searchers love specifics. Expand broad terms:- “life insurance” → “life insurance for new parents UK”

- “business loan” → “unsecured business loan for startups UK”

- “SME health cover” → “health insurance for companies with under 20 employees”

These avoid head-term competition and attract decision-ready users

- Use data tools for volume & difficulty

Tools like SEMrush, ahrefs, or Google Keyword Planner help you evaluate search volume, keyword difficulty and CPC (often high in FS, indicating competition)

If your company operates in multiple countries and serves customers in different languages, read our guide to multilingual PPC keyword research must-dos.

2. Strengthen E-E-A-T, critical for YMYL financial content

Finance web pages fall under Google’s Your Money or Your Life (YMYL) category, meaning they must uphold the highest levels of quality. Strengthening your Experience, Expertise, Authoritativeness, and Trustworthiness (E-E-A-T) begins with credible authors, transparent sourcing, and consistent compliance review. Three simple improvements can go a long way to strengthen your E-E-A-T:

- Display expert bios, certifications, and regulatory information.

- Add clear definitions for complex terms.

- Ensure every page is factually correct and backed by vetted data.

Trust-breakers to avoid: In 2023, a number of high-profile celebrities, including Lindsay Lohan and Jake Paul were charged $400,000 for violating disclosure rules. They were paid to promote crypto tokens, but failed to disclose that. This should serve as a reminder that financial services compliance applies not just to content on site but also on the wider web. Misleading consumers with insincere reviews is illegal, and will hurt the perceived trust of any site indulging in such deceptive practices.

Google’s quality raters look for signals that indicate your content won’t mislead users making financial decisions. AI-based search platforms like ChatGPT also consider the same principles of E-E-A-T when scoring finance website and app reliability. To learn more, read our guide to YMYL Trust: E-E-A-T for Financial Services SEO.

3. Prioritise technical SEO, speed, and bulletproof security

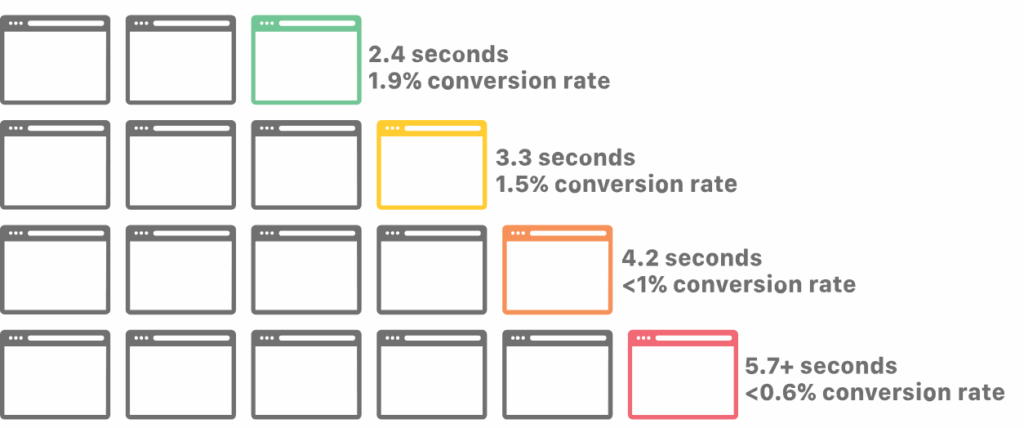

Financial users demand exceptionally smooth experiences. Slow, unstable, or unsecure websites fail Google and ChatGPT’s high standards instantly. Optimise Core Web Vitals, reduce unnecessary scripts, and ensure fast-loading mobile pages. Finance sector apps and sites must also maintain top-level security hygiene: full HTTPS coverage, secure form handling, and no broken redirects.

Technical errors can directly reduce conversions; a single second of delay lowers conversion rates by 7%. In financial services, where trust is everything, performance and security directly influence brand perception.

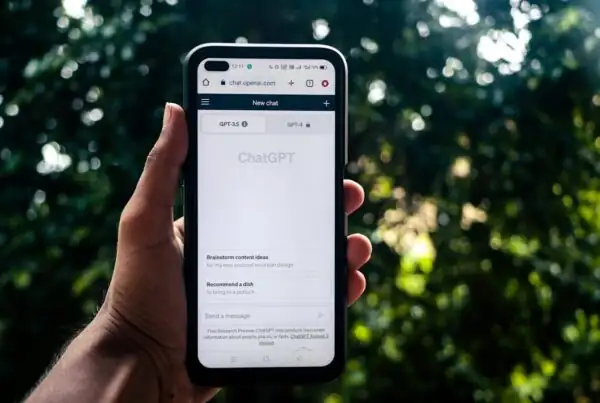

4. GEO: SEO for AI search visibility

Search is rapidly shifting from traditional 10-blue-links to AI-generated answers. Google’s AI Overviews, Microsoft Copilot, ChatGPT Search, and Perplexity are increasingly shaping how users discover financial information. To ensure your financial brand is included in answers on these structured, conversational engines, focus on:

- Clear, structured content with concise summaries and well-defined headings

- Factual, citation-friendly information (AI models rely heavily on trustworthy sources)

- Compliance proofing, since AI systems avoid unreliable or unverified content

- Expanded topical depth, answering the full context behind a query

- Strong E-E-A-T, as models prefer authoritative financial voices

Partnering with a GEO agency is quickly becoming essential for financial brand marketing, since AI engines may drastically reduce click-through to websites if a brand is not considered as the trusted source.

A recent breakdown shows that for finance queries, AI Overview visibility increases dramatically with longer, more informational searches – finance AIO visibility goes from 11% on short queries to almost 79% on very long ones (9-10 word queries).

We recommend starting with a GEO workshop, followed by a benchmarking exercise to help your team work through the complexities of GEO layered on SEO.

5. Implement financial schema markup to improve visibility

Structured data markup can help search engines and AI LLMs interpret your key financial content with precision. This is especially important on large banking sites and complex, dynamic fintech and insurtech websites. Adding schema like FinancialService, FinancialProduct, BankAccount or PaymentCard allows algorithms to better understand structured content on your pages, and increases the likelihood of your content being cited by AI engines and appearing in enhanced search engine results features.

Schema also supports compliance by clearly defining the nature of your financial products or services, reducing the risk of misinterpretation by search algorithms. Our experts recommend:

- Add finance-relevant schema types where relevant.

- Mark up rates, fees, services, and processes where possible.

- Add FAQ schema to improve AIO and rich-result eligibility.

- Use HowTo schema for step-based processes (e.g., “How to apply for a loan”).

- Maintain structured data hygiene to avoid errors in Google Search Console.

Our guide to technical SEO for financial institutions provides further information on implementing schema for financial services rich results.

6. Develop high-value, trust-building financial content

Financial consumers have extremely low tolerance for unclear or salesy messaging. They want content that answers questions, clarifies complex products, and empowers confident decision-making. Create robust resources such as comparison guides, calculators, eligibility or risk-assessment tools, and regulatory explainers. High-value content increases dwell time and positions your organisation as a trusted, knowledgeable partner. In industries like insurance, retirement planning, and SME finance, helpful tools dramatically boost lead quality.

To achieve this, we suggest:

- Write clear, fact-checked, compliance-approved content

- Include data, formulas, definitions, and real examples

- Use comparison tables with disclaimers for transparency

- Break down complex FS topics into skimmable sections

- Add downloadable guides, calculators, and expert insights

Learn 7 strategies to improve trust for fintech SEO.

7. Build authoritative finance backlinks

Search engines treat backlinks to financial sites with heightened scrutiny. A few strong links from reputable finance publishers, trade bodies, government sources, or respected business sites can outperform dozens of generic backlinks. Prioritise high-trust placements like industry reports, financial education articles, and expert commentary. FS backlink strategies benefit enormously from PR campaigns, industry partnerships, and proprietary research that earns natural links. For this you can:

- Use data-driven PR: original research, surveys, or economic reports.

- Join finance associations and industry bodies.

- Publish thought-leadership articles from senior analysts.

- Avoid low-quality or irrelevant directories that can violate FS guidelines.

We’ve written a detailed guide to link building and digital PR in regulated financial markets. It is recommended reading for SEO, marketing and PR personnel in the FS industry.

8. Strengthen local SEO for branches, offices, and advisers

Despite digitalisation, many financial products still involve regional consultation or support. Local SEO ensures users in your target catchment area can find you. This includes optimising Google Business Profiles, creating location-specific pages, building local citations, and encouraging compliant customer reviews. Local search visibility is especially crucial for services like mortgages, pensions advice, and commercial insurance, where trust and proximity influence decisions.9. Audit and Refresh Content Frequently to Maintain Compliance

An often forgotten aspect of digital marketing is the work banks, IFAs and insurance brokers need to put into local SEO.

9. Supplement SEO efforts with Google Ads

While not strictly an SEO tip – because no, advertising on Google does not directly impact organic rankings – investing in Google search ads has an impact in three ways: (1) it allows you to attain two points of presence on the search results page, (2) it builds brand and product awareness, which translates to brand mentions in the media and on discussion forums over time, and (3) studies have shown it helps grow brand trust.

Over a decade ago, Google conducted a study on the impact of organic rank on ad click incrementality. They researched how the incrementality of the ad clicks varies with the rank of an advertister’s organic results. While these numbers are likely to be very different today, especially with the growing presence of AI Overviews, they are still an indicator of the power of combining two search channels rather than focussing on organic alone.

Source: Google – “Impact Of Ranking Of Organic Search Results On The Incrementality Of Search Ads”

10. Align all SEO output with compliance from the start

Compliance should not be an afterthought in finance website SEO. Every piece of content, from web pages to calculators to blog posts, must meet legal and regulatory guidelines. Establish a workflow where compliance reviews occur before publishing. Clear disclaimers, accurate examples, and transparent product details build user confidence and ensure Google recognises your content as trustworthy. Brands that demonstrate consistent compliance earn more durable rankings and avoid content suppression.

In finance, product details, interest rates, and regulatory guidelines change rapidly. Outdated content can hurt both rankings and compliance. Create a rolling schedule for reviewing product pages, FAQs, blogs, and legal disclosures. Update old articles with recent data and re-optimise them for evolving user intent. Google rewards sites that maintain fresh, accurate, and trustworthy information, a huge advantage in Financial Services SEO.

How AccuraCast helps finance brands win in organic search

The financial sector requires a specialised, evidence-based approach to SEO. Our team at AccuraCast integrates behavioural insights, regulatory knowledge, AI-driven optimisation, and advanced analytics to help financial brands build authority, gain visibility, and attract high-value customers. Explore our SEO services for finance companies.

Our comprehensive SEO guide for financial services is a great resource for in-house SEO teams and digital marketing leaders, covering everything from the ground up, and it includes real-world case studies to help you understand and contextualise methodology.

Last, but not least, we have a number of resources in the insights section of our site to educate brands on AI search optimisation, and a range of generative engine optimisation services to support finance companies.

Get in touch if you’d like to speak to one of our finance and SEO experts to improve your organic search rankings.

Ruben is a digital marketing consultant at AccuraCast, in charge of developing and executing effective digital marketing strategies. His specialities include digital strategy, paid media and programmatic for financial services brands.