by: Ruben Annaratone

Local SEO Considerations for Banks, IFAs and Insurance Brokers

Financial services firms such as banks, mortgage brokers, IFAs, insurance brokers, loan providers, accountants, tax advisers, bookkeepers, payday lenders, and regionally focused B2B finance providers all rely on footfall into their business locations. Local SEO and branch finder optimisation is an important component of a financial services SEO strategy, especially for such companies.

Why local SEO is essential for financial services branches

Any business that relies on customers visiting their premises needs local SEO to ensure they can be found on searches in Google Maps, Apple Maps, on the local business results within the main Google search results for proximity-based searches, and more recently for localised prompts in AI search platforms.

The shift to ‘near me’ searches

With the proliferation of smart mobile devices, the last decade saw a dramatic rise in the number of ‘near me’ searches. Data from Google Trends shows over the past five years, this number has held relatively steady for discovery searches (e.g. “banks near me”) as well as brand-specific searches (e.g. HSBC branch).

72% of consumers use Google search and 51% of consumers use Google Maps to look up local business information. Research from Google found that 76% of people who search on mobile for something nearby visit a business within a day.

Search visibility is an obvious precursor to physical foot traffic and appointments today.

Critical role of E-E-A-T in local financial services

Trust is critical in YMYL (Your Money Your Life) businesses. The presence of a local branch often engenders trust in and of itself. Positive reviews in local news, word of mouth, and strong online reviews enhance trustworthiness, which is a crucial component of E-E-A-T in financial services.

Google and conversation AI platforms like ChatGPT rely heavily on E-E-A-T signals when deciding which businesses as worthy of mention, especially in YMYL sectors like personal finance and insurance. Conversely, for brands in these sectors, it is not just sufficient to optimise for visibility; they also need to earn consumer trust, and maintain it.

Discover our comprehensive financial services SEO agency offering, as well as our specialist fintech SEO services and SEO for insurers and brokers.

How to optimise Google Business Profile (GBP) for every branch

Businesses on Google Maps get a free Google Business Profile – previously known as Google My Business and Google Local Business Center. Every single branch needs its own GBP listing, which can include essential information like phone numbers and operating hours, photos and logos, and more recently, information about the businesses’ minority ownership or LGBT-friendliness.

The following three tips will help ensure your Google Business Profile is optimised for local search visibility:

Claiming and verification for multi-location chains

Whether you operate a single location or have branches spread across five continents, the first step is to claim and verify every location.

For individual locations (or less than 10 branches):

- Search for your business name and location on Google

- If it isn’t listed, you can add your business

- If you haven’t already, click the link to “Claim this business”

- Click to manage your business

- Select “Get verified” and then select one of the offered verification methods: Phone or SMS, Email, Video recording, Live video call, or Mail (postcard)

For multi-branch chains (bulk verification for 10 or more locations):

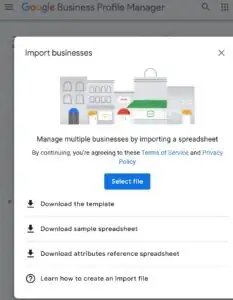

- Sign in to Google Business Profile Manager

- If you see the option in the left menu, click Verifications > Chain > Start, then fill in the form and click “Submit”

- If you already have individual locations in GBP you might not see the above option. In that case, click the button to Add business > Import businesses, and then follow the prompts. Google provides a template and sample spreadsheets for reference.

It can take up to five business days to get verified. Poorly maintained listings can be unverified, especially if customers frequently complain that the branch was closed when it was meant to be opened or if it wasn’t located where the listing claims it should be.

Tips to optimise your GBP

Ideas to leverage GBP posts and Q&A

Google Business Profile Posts appear in search and Google Maps when users view your listing. They can boost engagement and CTR, and trust signals for your brand.

6 post types financial services firms can use to build trust:

- Educational content – Provide tips and guidance related to your services. E.g. “How to protect your business from cyber fraud.”

- Local events – Reinforce your presence in the community. E.g. “Join our free healthcare workshop for expats.”

- Product updates – Raise awareness and keep your offering current. E.g. “We now offer free investor accounts for teens.”

- Regulatory notices – Maintain transparency and increase customer trust. E.g. “FCA has authorised advisory services…”

- Seasonal guidance – Relevant timing can drive appointments. E.g. “End of year tax planning appointments.”

- Partnership highlights – Build local community and potentially earn backlinks. E.g. “Proud to support our local girls under 15 rugby team.”

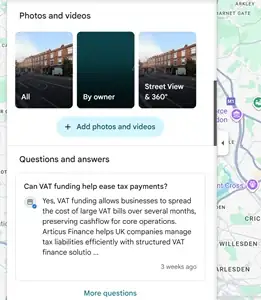

The GBP Q&A section often fuels “people also asked” queries, which makes this feature valuable for long-tail local search and reputation management. We often find this feature underutilised by retail finance and insurance firms. These questions can even be seeded by your team, to answer frequent customer queries.

5 Proactive Q&A ideas for finance company Google Business Profiles:

- Practical questions – Improve usability and experience. E.g. “Is parking available near the branch?”

- Service clarification – Target local search intent. E.g. “Do you offer commercial lending advice in-person?”

- Regulatory reassurance – Build credibility and mitigate risk. E.g. “Are you FCA-authorised to…?”

- Financial guidance – Position your team as helpful experts (without crossing the line into providing advice). E.g. “What documents do I need to….?”

- Logistics – Reduce friction and encourage higher-conversion customer journeys. E.g. “How long does an appointment take?”

Advanced branch finder and local page optimisation

Branch finder features are specific to large financial institution such as retail banks. Optimising the local pages can boost visibility in search.

Architecture and user experience (UX)

Structuring the architecture of local branch pages for discovery within a large enterprise site requires a well thought-out internal linking and navigation structure. The optimal URL structure for branch pages should follow this format:

/locations/city/branch-name/

Given the majority of people searching for location-specifics on Google are on mobile, it goes without saying that branch finders and the local pages need to be mobile-friendly and easy to use.

Optimising individual branch pages

While it is expected for marketing teams and webmaster handling complex websites for large financial institutions to automate the content creation for individual branch pages as much as possible, these pages require the following SEO basics to increase their chances of ranking top of search results:

- Unique title tags and H1 page headings

- Recommended format for the title tag: Business name – city – branch – services

- Specific local content. This can be in the form of:

- Unique services offered in the branch

- Specialists working in the branch

- Branch manager info

- Transportation and directions to branch

- Local info, where relevant

- Local keywords naturally woven into content about the services.

Implementing local business schema markup

Marking up NAP (name, address, phone number) info with structured data schema can enhance local SEO, in keeping with the point made earlier about NAP consistency. When implementing technical SEO for financial institutions, using LocalBusiness or even more specific schema for financial services, such as FinancialProduct, BankAccount, LoanOrCredit, PaymentService etc. clearly defines your business entity and properties such as interestRate, cashBack and loanPaymentFrequency to Google.

Schema markup for hours of operation and specific services offered can further enhance local search listings, and improve the user experience.

Learn about other technical SEO and security & compliance considerations for financial institutions.

Local citations and link building for trust

Since the start of Google, links have been fundamental to SEO success. While the way Google – and other search engines – now evaluate links has evolved, the fundamental concept behind links being an indicator of website quality and authority remains. Local SEO requires link building, and an additional layer of local business citations – online references to the business’ key identifying information, including the name, address, phone number, and often website, operating hours, and business category, on a third-party website.

Auditing and cleaning citation profiles

Finance firms need to ensure presence of each branch location on key third-party directories such as Yell. Yellow Pages and Thomson Local. It is just as important to fix incorrect listings to maintain NAP consistency. This also includes identifying duplicate listings and removing them.

Local link building and community engagement

The local backlink profile signals authority to Google, as well as relevance to the location. While most big financial institutions have high domain authority, webmasters and SEO teams often overlook the importance of acquiring local backlinks.

5 easy ideas for local link building

- Partner with local organisations – such as universities, colleges, chambers of commerce, charities and business hubs.

- Create helpful localised resources – such as guides specific to the local area, reports with local data and insights.

- Local PR – provide quotes to local journalists, create press releases about local branch openings, CSR initiatives or community events.

- Build relationships with local businesses – feeder businesses, e.g. estate agents feeding into mortgage advisers or travel agents feeding into insurance brokers, and resellers e.g. local banks offering co-branded investment plans or payroll platforms / advisors offering benefits programmes, can be great sources of links.

- Local community initiatives – such as volunteer schemes and sponsoring local causes, as well as self-hosted educational workshops.

For fresh ideas read this article about link building and digital PR in regulated financial markets.

Harnessing reviews and reputation management locally

Reviews are one of the strongest E-E-A-T signals. Finance firms can reinforce trustworthiness by focusing on a reviews and reputation management strategy.

Strategies for generating authentic reviews

Setting up a compliant strategy for earning more positive reviews can pay off manifold for financial services brands. Encourage satisfied clients to leave feedback by emailing them review links following a positive customer service interaction, or prompting them in-branch.

Reduce friction when requesting reviews:

- Opt for popular review platforms over niche, industry-specific sites.

- Provide QR codes or short links.

- Highlight the ease of leaving a review, e.g. “it only takes 30 seconds.”

- Guide the user on what specifically you want feedback on.

Remember: you may request honest feedback, but never attempt to influence what the customer writes!

Responding to all feedback (positive and negative)

Responses show accountability, which in turn builds trust for users and Google. While it’s natural to want to argue with negative reviews, we strongly encourage our clients to respond to positive reviews with a polite, personalised response, and establish a clear, robust strategy to handle negative reviews.

Taking a negative review offline quickly avoids a public spectacle, but we recommend personalising responses here too, as a series of replies saying “Please contact our customer services team” quickly starts looking impersonal and contrived.

Measuring local SEO success and next steps for finance firms

The GBP platform provides reports on local searches for your business, detailing key metrics. Beyond that, we recommend tracking real business outcomes from your local SEO efforts.

Key performance indicators (KPIs) for local financial services

Thee key sources of data should be considered to get a robust view, GBP, Analytics, Ranking / visibility tools. Key metrics you should be tracking include:

- Number of people who viewed your Business Profile

- Sources of Profile impressions

- Keyword searches showing your Business Profile

- Profile interactions – calls, bookings, directions, website clicks

- Organic traffic referrals to branch pages

- Local-pack visibility and localised keyword rankings for your business.

Future-proofing for voice and AI search

The rapid growth of conversational AI is changing the way financial customers find and consider solutions. Optimising for visibility on generative AI search will ensure your audience finds you whether they’re looking on traditional Google search, in AI mode, or on ChatGPT.

By focusing on structure, clear language, and trustworthy local content, finance brands can position to be the definitive answer when someone asks “who is the best ____ near me?”

Future-proofing for voice and AI search will align your digital presence with how people actually seek financial help today.

If your finance firm needs to improve local search visibility, talk to us about our finance SEO services.

About the Author

Lourenço Gonçalves

Lourenço is a Senior SEO Executive at AccuraCast,

responsible for the strategic and tactical elements of Organic channel acquisition. He has over 10 years of experience working with international financial services, travel and retail brands in Europe, North and South America.

Ruben Annaratone

Ruben is a digital marketing consultant at AccuraCast,

in charge of developing and executing effective digital marketing strategies. His specialities include digital strategy, paid media and programmatic for financial services brands.

Register now

Connect with digital professionals, explore new marketing ideas, and learn from real-world success stories. Register today to receive your access details.

Recommended For You

- Dec 17, 2025

How to Increase International Brand Visibility in ChatGPT

International search is no longer just about rankings, keywords and…

- Dec 4, 2025

10 Evergreen Financial Services Marketing Strategies

Financial services is a trust-heavy, highly regulated industry where acquisition…