by: Lourenço Gonçalves

The Ultimate Guide to SEO for Financial Services

Search is where most online journeys begin. Today, consumers as well as business buyers turn to their preferred search engine or conversational AI platform to find solutions for challenges they face. In the world of finance, these searches often lead individuals through complex journeys across multiple platforms before they make a purchase decision.

Financial services SEO is the most cost-effective way for organisations in the finance and insurance sectors to reach customers right from the start of their buying journey, up to the point of purchase, and even beyond.

SEO is a growth lever for banks, fintechs, wealth advisors and brokers. Ranking in the top 3 organic search results still drives huge traffic volumes, and can build brand awareness and trust. Organic search is the preferred channel for most financial marketers, not just for the low cost clicks. When a brand appears consistently at the top of search results, it becomes more recognisable and perceived as an authority on the topic.

Attaining top-of-page rankings for popular finance-related terms isn’t easy though. The space is highly competitive, and new entrants often go up against established firms with strong brand recognition, decades of mainstream press coverage with links, and a vast repository of content built over the years.

This comprehensive guide covers all the main considerations for marketing, dev, copywriting, PR and compliance teams involved with SEO in finance businesses.

Contents:

- Why SEO matters in financial services

- Building the foundations: E-E-A-T & trust

- Keyword & content strategy for finance brands

- On-page SEO for financial firms

- Local SEO for financial firms

- Technical SEO & compliance for finance websites

- Link building, digital PR & authority in regulated markets

- Sector differences for finance SEO

- Measuring SEO success in financial services

- Future trends: AI search & generative engines in finance SEO

- Conclusion & next steps

Why SEO matters in financial services

Search engine optimisation drives qualified traffic to websites at no cost per click. BrightEdge estimates over 50% of referral clicks to finance websites come from organic search, and 1% from AI search, though the latter is growing rapidly. Overall, organic search still is the second largest driver of financial website traffic, accounting for nearly 20%, behind direct traffic, which Similarweb finds is the biggest source for major finance brands.

Finance customer journeys start with search

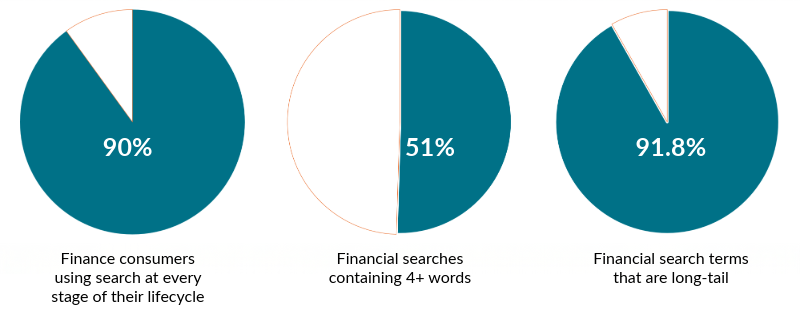

According to Invoca, “Most financial services consumers start their journey by finding and comparing providers online, often through search.” LSA research finds 90% of loan and mortgage consumers, 85% of check cashing consumers, and 76% of tax return preparation consumers start their journey with an online search.

Source: LSA Insight – Percent of finance consumers that ran a search before converting

Organic search ranking implies trust

Consumers inherently trust the top organic search results, because they believe that position is earned. For challenger brands in the finance industry, this is an invaluable means to build and maintain customer trust.

Long tail queries present education opportunities for financial brands

In many sectors of finance, customers research their options to a great extent before even getting in touch with a provider. Customer journeys can include anywhere from 7 to 21 touch points on average. Each of these gives brands a unique opportunity to grow awareness, educate customers, and build trust in the brand.

High CPCs for paid search ads

Competition for top-of-page sponsored listings for finance keywords on Google is fierce. Wordstream’s latest data shows the average cost per click on finance & insurance searches in the USA is $3.44 and on Google’s Display Network it’s $0.86. However, CPCs on finance terms in the UK can go from an estimated average £5.28 to as high as £55 per click. SEO is much more affordable in comparison.

Finance brands aggressively build search presence

Any financial services brand that isn’t investing in SEO is more than likely losing out to competitors, many of whom have been aggressively growing their organic search presence over the years, and already have strong trust and backlink profiles earned through decades of PR and brand building.

Building the foundations: E-E-A-T & trust

Google classifies finance content as YMYL (Your Money or Your Life). This means their platforms apply very high minimum quality requirements for all financial content.

What is YMYL content?

YMYL is an abbreviation for Your Money or Your Life. It is a concept introduced in Google’s Search Quality Rater Guidelines to describe “topics could significantly impact the health, financial stability, or safety of people, or the welfare or well-being of society”.

Google search quality raters apply very high Page Quality (PQ) standards for pages dealing with YMYL topics, because the appearance of low quality pages – especially those with misleading information – at the top of the search results could potentially impact the health, financial stability, or safety of people, and could even significantly impact societal welfare on the whole.

What is E-E-A-T?

Google search quality guidelines first introduced the concept of expertise, authoritativeness and trustworthiness (E-A-T) as indicators of quality content back in 2014. More recently, in 2022, the search engine released a major algorithmic update to prioritise higher quality content. Along with this update, they added experience to the E-A-T framework.

Thus, E-E-A-T is an abbreviation for experience, expertise, authoritativeness and trustworthiness. Google’s algorithm considers a number of factors that indicate which content demonstrates the highest combination of E-E-A-T. While E-E-A-T itself isn’t a direct ranking factor, it helps Google’s algorithm, as well as their search quality raters, identify higher quality content for YMYL topics.

Learn more about E-E-A-T for Financial Services SEO in our detailed guide to earning YMYL trust.

Within E-E-A-T, trust is perhaps the most important, and most difficult to earn, for financial services brands.

How to demonstrate real expertise

The first step to demonstrate E-E-A-T is to clearly indicate who created the content, and whether they are credible experts in the field, qualified to talk about the topic. Company and author expertise is demonstrated through clearly stated credentials, author bylines – ideally linked to detailed bios – and company case studies.

Case study: Chase Belgrave

The challenge: When AccuraCast’s client, Chase Belgrave wanted to grow their organic search presence, their biggest challenge was establishing expertise and earning customer (and search engine) trust. Being a financial services company focused on expat wealth management, Chase Belgrave’s content clearly dealt with a YMYL topic.

The solution: People only hand over their money to businesses they trust. Our solutions aimed at helping the firm earn that trust. This was done through extensive digital PR, and putting their experts front and center.

All content published on the company site and all press coverage featured pension experts and/or expat finance specialists.

The results: The direct impact was an increase in organic search visibility, and organic traffic to the website increasing over 20% over the course of a year.

More importantly, the brand started earning more positive reviews on third-party sites. The reviews often specifically mentioned the experts in the firm, building that expertise and trust further.

The role of compliance in demonstrating trustworthiness

Finance is a highly regulated sector in most countries. Government-appointed regulatory bodies such as the FCA, SEC, ESMA, EBA and EIOPA lay down strict rules on what can and cannot be said in any financial marketing materials. These rules can go so far as to dictating when and where disclaimers are required.

Fintech and insurtech firms need to pay more attention to demonstrate trustworthiness. Challenger brands are not only lesser known by consumers than their legacy competitors but they also typically have much less mainstream press and media coverage, which means their domain authority and trust ends up being lower.

Read our guide on 7 strategies to improve trust for fintech SEO.

Data privacy is an important factor when demonstrating trustworthiness in YMYL sectors. Consumers – and search & AI platforms – want to ensure that private financial data will not be easily hacked, misused by unscrupulous marketers or fall into the wrong hands. In addition to displaying regulatory compliance trust marks, it is important for finance organisations to also demonstrate security measures, especially on any page where users share personally identifiable information.

AccuraCast’s trust signals checklist

Trust & compliance signals

- Display FCA or relevant regulatory registration number clearly.

- Link to official regulator registration for verification.

- Show compliance disclaimers and risk warnings on all advice and product pages.

- Use HTTPS and up-to-date security certificates.

- Include a transparent privacy policy.

- Display a cookie consent banner, and respect user consent choices.

Contact transparency

- Provide clear company address and phone number.

- Display physical office location(s) and list them on Google Maps.

- Include accessible customer support and complaint procedures.

- Show clear product terms and maintain fee transparency.

Credibility & authenticity

- List real team members with bios and credentials.

- Add author bylines with credentials on all articles, with links to detailed bios.

- Display team member – especially advisor – certifications (CFA, DipFA etc.)

- Show publish dates and review dates on all advisory content.

- Cite credible financial or government sources in content.

- Feature compliance verified client testimonials or case studies.

- Include press mentions and media coverage links.

Social proof

- Showcase industry partnerships, association membership badges, awards.

- Embed review site widgets (Trustpilot, Capterra etc.)

- Display independent ratings and performance reviews.

- Link to verified brand social media profiles.

Keyword & content strategy for finance brands

On-page content is the core of any SEO strategy. Building the content strategy starts with keyword research. By identifying the widest possible range of keywords or prompts customers searches for, finance marketing teams can map out how current content on the site answers those customer queries, and identify gaps in the current content.

Financial keyword research by intent

Keyword research must be segmented by intent. Informational keywords – such as “what is an ISA”, “how to raise growth funding”, etc. queries indicate people at the awareness stage of their buying journey. Transactional or commercial keywords – such as “best stock trading platforms”, “compare insurance quotes” etc. queries indicate people considering or ready to make a purchase.

Source: Yext – “Why intent marketing matters in financial services” and Promodo – “The most searched financial keywords for higher rankings”

Content delivered by search engines and conversational AI for informational keywords will be more educational in nature, whereas content shown on transactional queries is likely to be more conversion-oriented.

Multi-national financial services firms should also pay attention to local trends and requirements. Even in countries where English is the primary language spoken, the keywords searched for may differ, and AI prompts are more likely to incorporate local nuance and regulatory differences.

Read our 6 multilingual keyword research tips.

When mining keywords, it’s important to not just focus on the high-volume search terms. Niche keywords such as “best savings account in UK”, “reliable IFA near me”, “small business loan rates without guarantor” may have low monthly volumes, but these terms signal high intent.

Content strategies must take intent into consideration. The key from an SEO point of view is to make content useful, which relates to the customer journey stage and search intent. In other words, if someone searches for “what are the types of mortgages?” they’ll expect to see educational articles, whereas when that person is ready to apply, they are more likely to search for “compare best mortgage rates”.

- Informational keywords → Educational content addressing problems

- Commercial keywords → Conversion-oriented content

- Situational keywords → ‘need-state’ content, which targets a user’s life events

AI Overviews are more likely to show for informational queries than transactional ones. This further implies the need for educational, AI citation-worthy content for informational queries.

For multi-national, English-only sites, as well as multilingual websites, localisation is crucial for finance. Compliance requirements differ from country to country. Good localisation gives finance firms the opportunity to better engage customers and further cement trust.

Our content localisation guide explains how to turn translation into true engagement.

Case Study: Hargreaves Lansdown

The challenge: When UK financial services company, Hargreaves Lansdown wanted to grow their organic search presence, they partnered with AccuraCast to guide and upskill their in-house team for implementation.

The solution: Our comprehensive SEO strategy included extensive keyword research followed by a tech and content audit covering the commercial, news, analyst insights, and stock market information sections of the site. This was supplemented with an SEO training programme for their tech, marketing, PR, and content teams.

The results: Identifying new, frequently-searched keyword targets uncovered new opportunities. In addition to increasing content indexability and keyword focus, AccuraCast’s experts empowered the client’s in-house team to produce more SEO-friendly content. Organic traffic increased 34% in a six-month period, and the number of pages being ranked on the first page of Google nearly doubled.

International content challenges

Localising content for the target audience helps build trust – not just because they understand the products better. It also signals longevity and an intention to stay around and invest in the region. Before tackling the localisation (not just translation!) considerations, multi-national finance organisations need to decide on a domain strategy.

Refer to our guide on international SEO domain structure best practices.

Regulation, economic conditions, market trends, and local linguistics, all play a very important role in determining the search habits and the type of content customers and search & AI platforms expect to see. As mentioned earlier, compliance requirements differ, even across markets that speak the same language. Audience awareness varies too from region to region. Financial firms must adapt on-page and off-site copy to match local audience expectations.

AccuraCast’s tips for writing compliant content

Writing compliant copy

- Always verify claims.

- Avoid untenable promises of guaranteed returns or “safe” investments.

- Include risk warnings alongside performance, investment or comparisons.

- Maintain audit trails of approvals and source materials.

- Avoid misleading superlatives such as “best” or “lowest” unless independently verified.

- Get compliance review before publishing.

Writing clear copy

- Use simple grammar and short sentences for easy understanding.

- Explain jargon and abbreviations the first time they’re used.

- Clearly state any assumptions alongside examples, projections or rates.

- Include context when comparing products or services.

Writing SEO copy with compliance in mind

- Use factual, intent-based keywords rather than misleading phrases.

- Write accurate, factual meta descriptions & title tags, avoiding superlatives.

- Demonstrate E-E-A-T across articles, information and product and service pages.

- Build content depth through linked guides that educate.

Writing process & governance

- Establish clear approval workflows between marketing, compliance and legal.

- Maintain a compliance glossary for frequently-used risk phrases.

- Train copywriters, PR, link builders and freelancers on marketing conduct requirements.

- Set review cycles for all content to ensure rates and product details are accurate.

On-page SEO for financial firms

Two key on-page factors determine organic presence for finance websites, relevance and E-E-A-T. Successful finance SEO requires paying equal attention to both of these factors.

Relevance is determined by search engines based on keyword and contextual matching of search terms to the main body content. Google and Bing look for relevance signals in key HTML elements in the page body – heading tags, above-the-fold content, especially the first few paragraphs, highlighted text and calls to action.

All important pages should show E-E-A-T. This rule applies to the homepage, service / product pages, and even articles / thought leadership content.

AI search isn’t too different in this respect. Relevance is just as important, though LLMs consider relevance at a higher level, on a broader contextual sense than simple keyword and content matching. And E-E-A-T is probably even more important for AI search optimisation than traditional SEO.

Read our guide to content marketing for gen AI search.

AccuraCast’s on-page SEO checklist for finance firms

Core on-page elements

- Write accurate, compliant title and description meta text including the keyword.

- Target one primary keyword per page.

- Include the keyword naturally in the h1 tag.

- Include the keyword naturally in the first paragraph.

- Include the keyword naturally in a couple of sub-headings (h2, h3).

- Add schema where content includes structured data.

- Use clean, descriptive URLs

Content quality and compliance

- Avoid any unsubstantiated claims.

- Use plain language, and define abbreviations / jargon clearly.

- Back up performance stats with third-party verification.

- Clearly state risks near any performance claims and calls to action.

- Ensure any predictions or projections as hypothetical and clearly state assumptions.

- Use disclaimers consistently, especially for performance and comparison data.

- Internally link to educational resources to demonstrate topical depth.

Demonstrate experience and expertise

- Mention real customer scenarios.

- Include verifiable testimonials and mini case studies on the page itself.

- Show credentials of authors / analysts / contributors and product owners.

- Add multimedia explainers where possible.

Build trust

- Display author or product specialist credentials, especially for investment and advisory content.

- Prominently display regulatory disclosures and compliance marks, such as FCA registration.

- Add expert review info and dates when content was reviewed.

- Use external citations from authoritative financial publications.

- Include transparent risk warnings on all product, investment pages and alongside performance content.

Content depth and structure

- Use semantic coding practices, with clear h2 and h3 hierarchies.

- Add FAQ content, addressing regulatory, risk and decision-making questions.

- Create topical clusters with pillar pages supported by in-depth guides.

- Avoid content duplication and “thin”, low-value content.

- Optimise Core Web Vitals to minimise page load times.

- Maintain accessibility with alt text on images, font contrast and adjustable font sizes.

- Ensure HTTPS and any security are maintained at all times.

Audit frequency and content refresh cycle

Financial services marketers must set up processes to refresh high-value pages every 3-6 months. This helps maintain content relevance, accuracy and compliance. Content that’s kept up-to-date strengthens E-E-A-T and signals to Google and ChatGPT that core financial content on the page is current.

We recommend quarterly SEO and content audits to identify technical issues, broken links, outdated content, and account for content decay before it impacts ranking or compliance. This should be topped-up with an annual content deep-dive review to ensure all product details, rates, regulatory statements and advice v guidance boundaries remain accurate and compliant.

Case Study: Accurity

The challenge: Switzerland’s leading payroll services provider partnered with AccuraCast to grow their presence online for two audience groups: individuals looking to work in the country and local businesses that hire international employees.

The solution: Our digital marketing strategy covered the three main pillars of growth – SEO, paid media and social media. The SEO strategy, in particular, involved optimising on-page content, identifying content opportunities, and promoting their online payroll tools to relevant authoritative and Swiss local sites.

The results: Over the course of a year, the client saw a 36% increase in average organic search ranking, with a 280% increase in the number of terms for which their website appeared on the first page of Google.

Local SEO for financial firms

Multi-branch companies should create location pages and optimise them to facilitate discovery and in-branch customer service. Setting up, optimising, and maintaining Google Business Profiles (GBP) is crucial if in-branch footfall is important. Read our local SEO guide for IFAs, banks & brokers.

Importance of NAP consistency

One critical local SEO factor to call out for finance companies is name, address and phone number (NAP) consistency. Stuffing location or product keywords into the business name will not help the branch location rank higher in Google Maps or in the local pack on organic search. In fact, for financial firms this can be damaging as it dilutes E-E-A-T an can reduce trust in the brand.

Local link opportunities

Fintech, insurtech and smaller finance firms that rely on local business should focus on local link and citation building. Local chambers of commerce, local directories, local business associations, even council directories can provide good local citation opportunities. Sponsoring local charities, community events, non-profits and even grassroots sports leagues and teams can build local brand awareness and earn links. Digital PR activities can focus on local news and community sites. Partnering with other non-competing local businesses is also a great way to earn local links.

Review management under regulation

Finance compliance regulations extend to review management. Reviews must be authentic, fair, and not selectively displayed by hiding negative feedback. Incentivised or paid-for reviews must be fully and clearly disclosed and must comply with additional consumer protection rules. Companies should not edit, script or manipulate customer reviews and testimonials. Any use of reviews in marketing should be clear, accurate and include proper context and disclaimers where relevant so as not to be misleading.

Review platforms that deal with financial services must support transparent handling, prompt response to complaints, and clear governance to satisfy FCA, TFC and CMA guidelines.

Technical SEO & compliance for finance websites

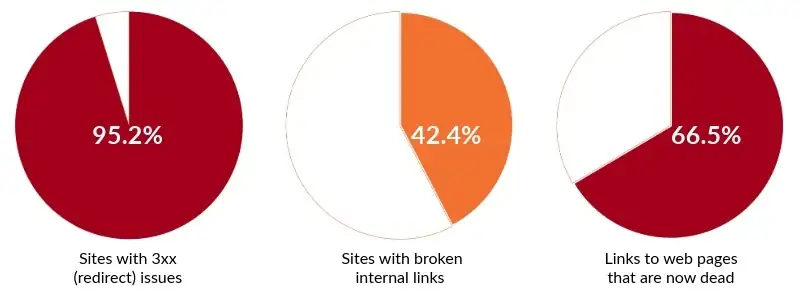

For large enterprise websites, the biggest technical SEO challenge tends to be ensure content is discovered and indexed. Very large sites with tens or hundreds of thousands of pages present specific challenges for search spiders to crawl and index all the content. Multi-national, multilingual enterprise sites add another layer of complexity in the form of duplicate content management across regional pages. Here are five important considerations for large finance enterprises:

- Large-scale internal linking – ensure product, educational and regional pages are well connected with a logical internal link flow, to avoid ending up with orphan pages or cannibalisation.

- Crawl efficiency and indexing – use hreflang and canonical declarations to identify regional pages to prevent duplication issues. Set precise robots rules and remove outdated content to stay compliant and avoid crawl bloat.

- Site performance with heavy security layers – Optimise Core Web Vitals with server-side rendering, selective script loading and image optimisation to prevent security protocols, encryption slowing down the site.

- Dynamic content accuracy – control crawl and structure for products with fluctuating data, such as rates or stock prices, so that duplicate URLs, parameter sprawl or outdated cached content don’t become compliance issues.

- Complex infrastructure – modern fintech sites often use complex, dynamic features that can present search crawl challenges. Establish platform-wide technical standards, and rigorously test search indexability.

Source: Semrush – “Most common website problems” and ahrefs – “Study of over 1 million domains to find the most common technical SEO issues”

In addition to the above considerations, both enterprise and SME finance firms should pay special attention to the following technical SEO considerations:

- Core Web Vitals – site speed and user experience isn’t just an issue for legacy banking sites or large finncial enterprises. Modern fintech and insurtech sites often use complex, dynamic elements that can slow down site speed and cause cumulative layout shifts. Pay attention to Core Web Vitals on Google PageSpeed Insights, and follow suggestions to improve the web and mobile score.

- Mobile experience – while it seems like a no-brainer today, traditional finance company sites often treat mobile experience as an after-thought, which can put them at a strategic disadvantage against fintechs. Google switched to a mobile-first index for websites from 2018, and completed this for all sites in 2023. Finance sites with a sub-optimal mobile UX risk a loss of organic ranking.

- HTTPS, security – we’ve mentioned earlier that HTTPS is a trust signal, and it is a core component of customer data security, which is critical for YMYL content. Ensuring the security of personal financial information is a regulatory requirement, and an important ranking consideration. Sites that are frequently compromised, or have downtime too often risk losing organic search visibility.

Read our detailed guide to technical SEO and security compliance for financial institutions.

Link building, digital PR & authority in regulated markets

From the day it was created, Google has considered links pointing to a website to be a very important indicator of authority. Most search engines now consider links among their key ranking factors. Websites with high-authority and relevant backlinks are more likely to rank at the top of organic search results than those with few or irrelevant links.

Differences between generic and regulated sector link building

Regulation extends to what finance companies can say in promotional materials – which includes PR and content created by link building agencies – on third-party websites. This means finance marketers need to be careful not to mislead or make exaggerated claims in the linked content. The usual entertaining, aspirational content that generic link builders may use could land finance firms in legal trouble for breaching compliance guidelines.

Ethical digital PR

This doesn’t mean link building is near impossible for finance. Thought leadership, data studies and expert commentary are great ways to build quality, editorial links from high-authority websites without falling foul of compliance guidelines.

Learn how to build links with digital PR in regulated financial markets. The article provides great compliant link building tactics and E-E-A-T-driven digital PR strategies.

Avoiding risky backlinks

Google requires any paid links to be clearly declared as “sponsored” or “ads” and marked with a “nofollow” attribute in the link HTML. Sneaky backlinks acquired by any form of payment or monetary incentive can risk websites getting a manual spam penalty on Google. But that’s not all. Finance firms are legally required to disclose sponsorships, paid guest posts, monetised blogger reviews etc. with ‘paid’ declarations. Failure to do so can risk severe regulatory penalties.

Building linkable finance assets

Our client, Accurity does a great job of creating useful tools that employers and employees in Switzerland can use to estimate net income and retention, and calculate sourcetax in 26 Swiss cantons. These tools attract organic links to the website purely due to their utility.

Other finance companies can similarly build tools that are relevant and useful for their clients. Beyond tools, proprietary research, original data, and case studies are also very linkable assets that any financial firm can produce fairly easily and share for compliant link acquisition. Just be careful to clarify methodology and declare any assumptions used in the tools!

Case Study: Expat & Offshore

The challenge: Expat finance specialist site, Expat & Offshore partnered with AccuraCast to grow their organic search presence. The website had a poor link profile with very low domain authority, which needed to be addressed promptly if they were to rank highly on organic search results.

The solution: Our digital PR and content marketing team created a series of link bait content ideas specifically for expats. These ranged from creating an interactive map of British food stores across the world, to sharing useful guides for expat pension transfers.

The results: Entertaining and useful link bait like the ‘Ultimate Interactive Guide of Great British Grub’ got picked up by leading national and expat-focused newspapers in over 20 countries, resulting in over 100 very-high-authority editorial links to the domain.

AccuraCast’s digital PR process

- Brainstorm ideas for link bait. These must be interesting and have wide enough appeal.

- Test feasibility of the idea, checking for data availability and content production costs.

- Test interest with a handful of journalist or bloggers who are likely to cover the topic.

- Create link-worthy content with a clear reason why publishers should link back to it.

- Outreach & journalist pitches in waves, starting with the top-tier publishers.

- Follow-up successful campaigns with additional, related sequels.

Sector differences for finance SEO

Fintech – prioritise speed, trust, and rapid growth in topical authority. Fintech SEO must keep pace with fast-moving product and consumer adoption cycles.

Discover our comprehensive fintech SEO agency services.

Banking & neo-banks – focus on local trust, all aspects of E-E-A-T, and technical optimisation. Large, complex site architecture shouldn’t block search and AI crawl and indexing.

Insurance & insurtech – emphasize high-intent content, especially comparison, and strong compliance clarity. The sector’s search results are saturated with comparison platform that invest heavily in SEO and link building.

Explore our specialist insurance SEO agency services.

Wealth management – build educational content, supported by visible expert credentials. Advisory content in this sector has high E-E-A-T expectations and is closely monitored by regulators.

Advisory – strengthen local authority and expertise signals. About us pages and informational content must demonstrate professional qualifications and transparent processes. Compliance marks should be clearly visible where applicable.

Investment management – ensure data accuracy and risk disclosures are present as per compliance guidelines. Analyst-level content depth is required to meet E-E-A-T expectations.

Measuring SEO success in financial services

SEO plays a vital role in the overall financial services marketing strategy. Demonstrating SEO’s measurable impact is essential for securing board-level alignment and investment. Quantifying SEO performance provides the evidence needed to elevate it strategic importance and to test and improve on-going efforts.

Monitoring and SEO dashboards

We recommend setting up SEO monitoring dashboards at three levels – practitioner, digital manager, executive / board. The practitioner dashboard should cover the most detail on keyword ranking, AI search visibility, links and authority. Manager-level dashboards typically combine SEO with other digital channels, and these dashboards should highlight organic traffic and customer acquisition, and major changes in search visibility. Board or executive-level dashboards should highlight the revenue impact of SEO and overall brand visibility in traditional and AI search.

AccuraCast’s KPIs

- Visibility – organic impressions, keywords ranking on page 1, brand mentions in AI answers.

- Organic traffic – CTR, clicks from organic search engines, clicks from ChatGPT & Perplexity.

- Qualified leads – raw leads and qualified leads where organic search was first click, last click, and supporting the journey.

- GBP interactions – local listing impressions, clicks, and engagement from Google Business Profile.

- Backlink quality – link sources, link source authority, traffic referrals, leads acquired.

How to attribute ROI for financial SEO

Financial purchase journeys are often long and convoluted, covering multiple channels and varied customer touchpoints. Using a multi-touch attribution model allows capturing the role of SEO – and other channels – in long, research-heavy conversion journeys.

We recommend mapping keywords or topics to commercial outcomes, such as qualified leads, sales, AUM growth, rather than superficial metrics like traffic or ranking, and measuring revenue uplift vs baseline. This is especially important with the growth of zero-click searches and the increasing frequency of AI Overviews appearing above organic search results.

Future trends: AI search & generative engines in finance SEO

The growth of AI has set in motion changes that are disrupting the way people search and discover financial content. AI Overviews now appear for a high percentage of finance informational queries, resulting in an increase in number of zerp-click searches and pushing down traditional organic search listings and local packs. Millions of people now use conversational AI platforms like ChatGPT, Perplexity and Copilot every day. SEO and marketing teams must adapt strategy, tactics, and performance measurement to this new reality. Firms that aren’t investing in upskilling in-house teams or partnering with a GEO (AI search optimisation) agency today risk becoming irrelevant in the near future.

What finance brands can do now to be GEO-ready

SEO and GEO have commonalities, but doing SEO alone isn’t enough to guarantee AI search visibility. Recent data from Semrush has shown the overlap between traditional organic search and AI generated answers in finance is less than 30%.

Here are five actions finance marketers can take now to become GEO-ready:

- Structure content for direct answers in the form of FAQs, step-by-step instructions.

- Build deep technical authority by creating content around key topics.

- Enhance E-E-A-T signals on existing content by stating author credentials, compliance-review dates and authoritative citations.

- Optimise for conversational queries rather than direct keyword matches.

- Maintain strict accuracy and recency by ensuring all rates, product information and regulatory disclosures are up-to-date.

Learn how to optimise for AI Overviews.

AccuraCast’s GEO roadmap for finance

We developed a structured generative AI search optimisation framework that enables financial services companies to start working on GEO with clear, manageable steps without adding unnecessary complexity to already demanding workloads.

- Benchmark visibility – understand where the brand is mentioned and identify opportunities.

- Prompt strategy – devise a clear strategy of prompt topics that matter to the firm.

- GEO content strategy – align content to prompt topics and identify any content gaps.

- Content optimisation – optimise content on an on-going basis, starting with the most important pages.

- Grow authority – earn third-party mentions and links to product and educational content.

Conclusion & next steps

If there’s one thing to takeaway from this guide, it’s the importance of trust, authority and compliance – they are the core pillars of the “SEO triangle” for finance. Focusing on all three will win half the battle!

Remember, there’s no shortcut to long-term SEO success. It requires consistent work and a focus on objectives that matter to the firm. Where the in-house team doesn’t have the capacity or capability to handle all the SEO and GEO activities we described above, partnering with a best-in-class financial services SEO agency like AccuraCast can ensure your brand grows organic search visibility and sales.

While this may seem like a lot to work on, we recommend starting with an SEO audit and a content optimisation plan. A structured, on-going plan to output content at a consistent pace will outperform bursts of activity over time.

If you need help getting started, additional support, or even just a second set of experts to review your current SEO, explore our comprehensive range or services and contact us – we’re always happy to help!

About the Author

Lourenço Gonçalves

Lourenço is a Senior SEO Executive at AccuraCast,

responsible for the strategic and tactical elements of Organic channel acquisition. He has over 10 years of experience working with international financial services, travel and retail brands in Europe, North and South America.

Farhad Divecha

Farhad is the Group CEO of AccuraCast.With over 20 years

of experience in digital, Farhad is one of the leading technical marketing experts in the world. His specialities include digital strategy, international business, product marketing, measurement, marketing with data, technical SEO, and growth analytics.

Paul Bennett

Paul is CMO of the Financial Services practice at AccuraCast.

During a 25 year career at AXA, as Global Brand Director, he undertook a complete transformation of the brand, taking it from an institutional brand to a top 3 global Financial Services brand. He then oversaw the rapid European growth of Huboo. Paul is an expert in brand building and a trained marketer and holds a Chartered Institute of Marketing Diploma.

Register now

Connect with digital professionals, explore new marketing ideas, and learn from real-world success stories. Register today to receive your access details.

Recommended For You

- Dec 10, 2025

Sports Digital Marketing Tips from Our Team of Specialists

Digital marketing in sport has been reshaped dramatically in recent…

- Sep 24, 2025

Sports SEO to GEO: How Sports Search is Evolving

TL;DR: SEO still matters. GEO is the next step: structure,…

- Jul 25, 2023

How To Increase Sports Fan Engagement Online

The way sports brands communicate with fans is continuously evolving.…