Live shopping generated $60 billion in global sales

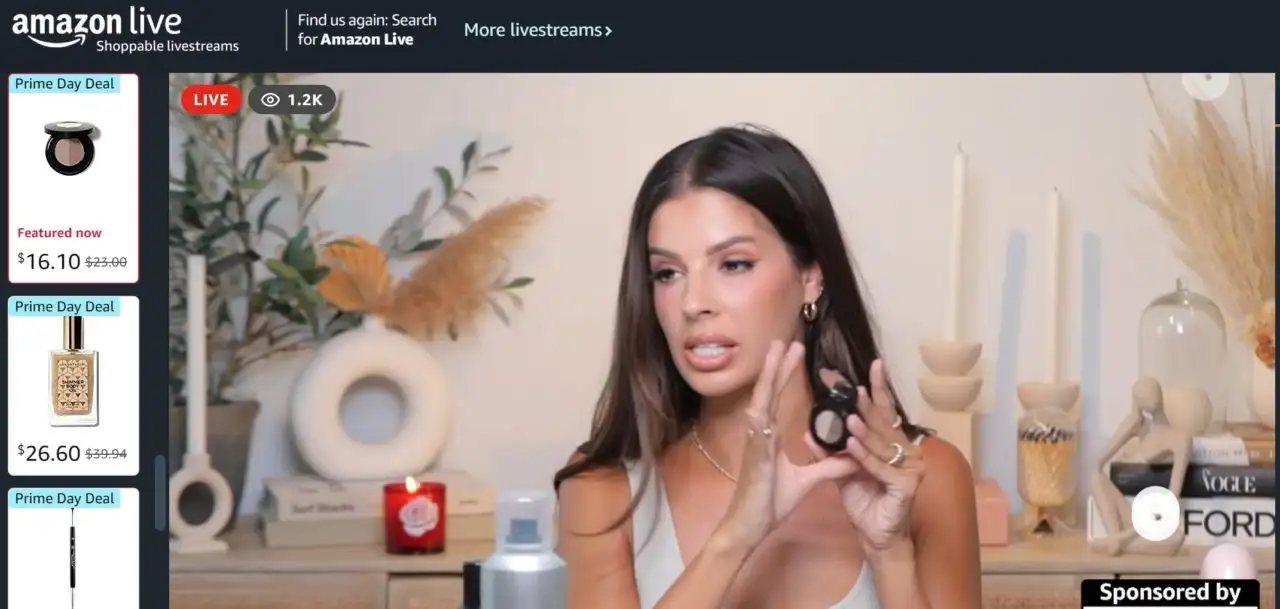

Amazon has stepped up plans to crack the QVC-style livestream shopping market, seeing it as the future of retail. It aims to replicate the success of social media rivals, such as YouTube, Instagram and TikTok.

This year, the company has hosted at least four events designed to attract more influencers to its Amazon Live platform, which it quietly launched in 2019.

Amazon’s goal is to establish itself as the main destination for live online shopping. It’s betting that western consumers will adopt live e-commerce with the same enthusiasm as has been seen in China, where sales generated through livestreams are projected to surpass $400bn this year.

While Chinese shoppers have embraced live e-commerce, the western market is in its infancy, according to analysts Coresight Research. They estimate the current size of this market in the US to be only $20bn this year, although the value of goods sold to US consumers via live shopping streams could reach almost $70bn by 2026 — representing about 5 per cent of all online shopping.

View what Amazon Live has to offer over at www.amazon.com/live.

Update: Meta has announced it will no longer provide a Live Shopping feature on Instagram from 1 Oct 2022.

About the Author

Luke was head of digital at AccuraCast